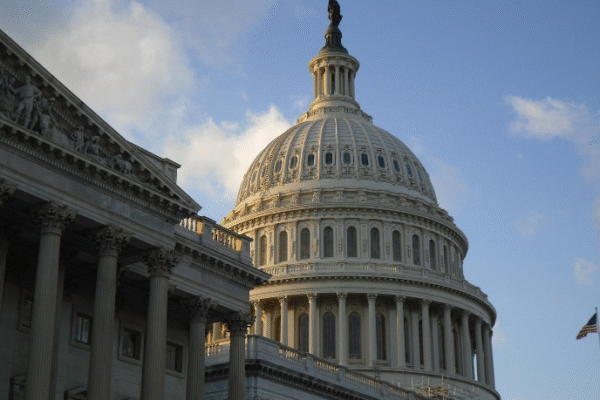

How the U.S. Minted 1,000 New Millionaires Every Day in 2024 and Why the Rich List Is Still Growing

The United States has long been a factory for fortunes, but 2024 was a breakout year even by American standards. According to UBS’s newly released Global Wealth Report 2025, more than 379,000 people crossed the seven‑figure mark last year an average of just over 1,000 new millionaires every single day.reuters.com The surge cements America’s status as…